III

BUSINESS PERFORMANCE REPORT

OF THE BOARD OF MANAGEMENT

As SHB marks its 31st anniversary, it remains one of Top 5 largest private joint stock commercial banks in Vietnam, demonstrating relentless growth and innovation. The Bank excels in two significant undertakings simultaneously: maintaining safe and effective business operations that meet international standards, and leading the implementation of major guidelines and policies set forth by the Government.

Over the past five years, steadfastly adhering to the Bank principle of “customer and market-centricity”, SHB has maintained stable growth in key business indicators, consistently outperforming the industry average with increases ranging from 15% to 25%. Notably, in 2023, despite facing macroeconomic challenges, SHB closely adhered to its planned objectives.

In 2023, despite the challenges posed by tightened finances and global market fluctuations, SHB managed to achieve significant successes. These achievements were attributed to the determination and capabilities of our entire domestic and international network, as well as the robust partners and customers partnerships, and the strong shareholder trust. All operational targets exceeded those of 2022 and closely aligned with our strategic plans:

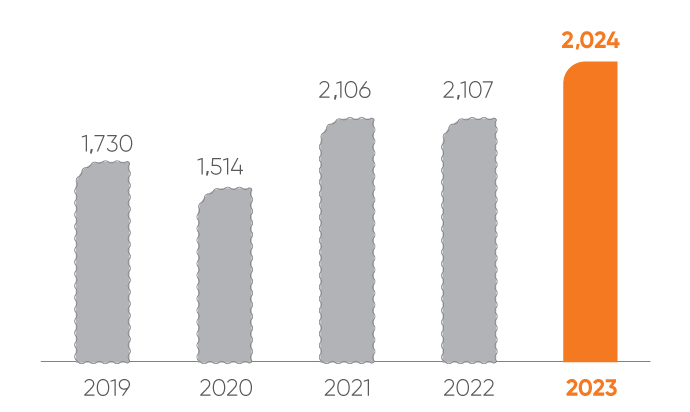

The network and staff continue to receive investment and expansion, accompanied by a focus on reorganizing the network, branches, and transaction offices to be streamlined and efficient, suitable for management capabilities. This is alongside enhancing operational scale, building a vast network, and developing modern distribution channels.

Through strong internal unity and consensus among the Board of Directors, Board of Management, and all staff, as well as decisive actions by the Board of Directors to enhance business activities, SHB has accomplished remarkable results outlined in the 2023 plan assigned by the General Meeting of Shareholder, including:

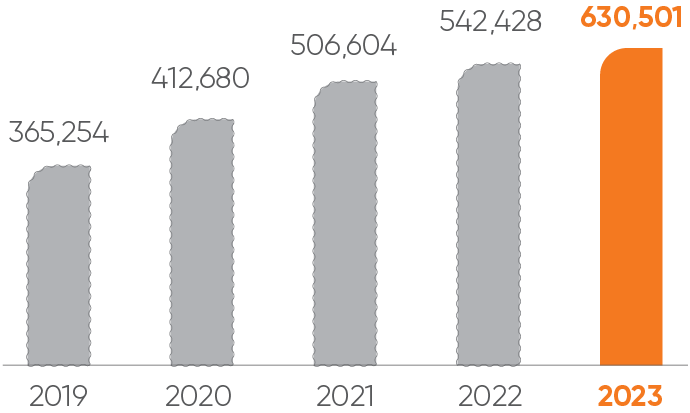

In 2023, SHB experienced a 16.3% increase in total assets, reaching VND 630,501 billion. This growth reinforces SHB’s position among the largest private joint stock banks in Vietnam.

Over the past five years, SHB has recorded an impressive average growth rate of 14.4% in its assets. This growth outpaces the average growth rate of the banking industry, which stands at approximately 11.4%.

In conjunction with its expansion, SHB remains committed to elevating the quality of its assets, ensuring a prudent asset allocation that guarantees both high returns and robust safety and liquidity. Specifically, the Bank aims to increase the proportion of non-interest income and reduce its reliance on lending.

As one of the five largest private joint stock commercial banks in Vietnam, SHB has proactively aligned itself with Government and SBV policies. Here are the key areas where SHB directs its financing efforts as part of the economic development strategy for the period 2021-2025: agriculture and rural areas, export-oriented businesses, SMEs, supporting industries, high-tech businesses and start-ups.

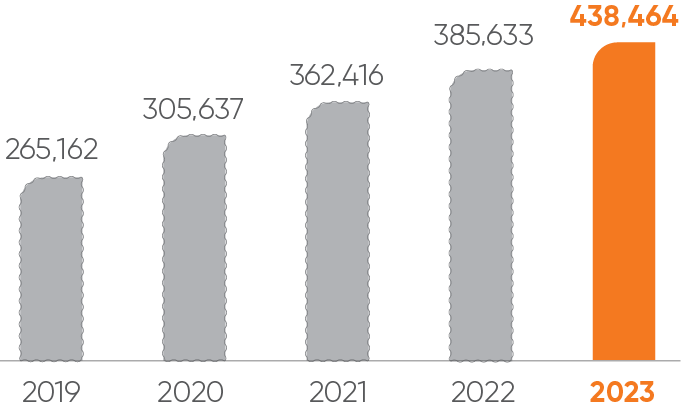

As of December 31, 2023, SHB recorded total outstanding loans amounting to VND 438,464 billion. Impressively, the growth rate of these loans over the past five years has consistently maintained at 15.2%.

SHB maintains a robust asset base, supported by a profitable and diversified loan portfolio. Outstanding loans to corporate customers amount to VND 358,053 billion, accounting for approximately 81.7% of the total outstanding loans. Meanwhile, Total loans to retail customers total VND 80,411 billion, representing about 18.3% of the total outstanding loans.

SHB remains steadfast in its customer and marketcentricity approach. SHB actively conducts research on its customers and the market to better understand the unique needs and preferences of each customer segment. By staying informed, SHB can tailor its products and services to meet specific requirements effectively and develop suitable and competitive products for the market.

SHB has proactively maintained and implemented several key lending programs and products, including: (i) financing for the temporary storage of rice seeds and grains during the Winter-Spring and Summer-Autumn crop, especially in collaboration with the Vietnam Food Association; (ii) supporting for aquaculture businesses and seafood processors engaged in export activities; (iii) extending credit to various sectors, including agriculture, forestry, fishery, and salt production, rural infrastructure development; (iv) providing supply chain financing and guarantees, (v) offering guarantees to real estate developers during the handover of future houses and to construction enterprises, supporting their projects and ensuring successful completion.

SHB proudly participates in the pioneering 2% interest rate reduction program, funded by the State budget at VND 40,000 billion, under Decree 31/2022/ND-CP and Circular 03/2022/TT-NHNN. This marks the first largescale interest rate support policy implemented through commercial banks. By reducing annual loan interest rates by 2%, SHB actively aids businesses in priority sectors, aligning with the government’s economic development objectives.

In addition to its core programs, SHB offers several major initiatives designed to support businesses and stimulate economic growth such as: (1) “Development Partnership with Major Enterprises”, (2) “Bluechip Preferential Loan Package”, (3) “Pilot Loans for Agricultural Development”, (4) “Agricultural Business Loans”, (5) “Interest Rate Incentives - Supporting Success”, (6) “Market Stabilization Loans”, and (7) Loan Interest Rate Incentives for Businesses, etc. These programs provide the following exceptional incentives:

SHB possesses a substantial corporate loan portfolio of significant value, enabling the Bank to extend its customer base further and diversify its loan portfolio towards SMEs and retail customers. Large businesses serve as primary clients, contributing to non-interest income. The Bank derives non-interest income from various services provided to these large customers, including cash collection, payments, account management, internet banking tailored for businesses, payment services, salary disbursements, foreign exchange services, and trade finance services. Each large enterprise customer acts as an anchor enterprise, typically having numerous SME suppliers and buyers within their supply chain. For each customer, SHB offers more than just financial support - it accompanies them from the initial stages of drafting business plans to providing comprehensive product packages. These packages include deposits, payment solutions, trade finance options, electronic banking services, and money transfers, all accessible through a modern electronic platform.

This approach empowers customers to proactively manage their finances with maximum efficiency. Moreover, SHB facilitates introductions and connections between businesses and reputable domestic and international organizations, empowering businesses to take charge of their business strategies. Additionally, the Bank provides valuable market insights, both domestically and internationally, including information on Vietnamese and global financial markets, as well as state-supported preferential policies for businesses. As a result of these comprehensive services, SHB’s products and offerings have garnered high praise from both domestic and foreign organizations. The Bank has been honored with numerous awards over consecutive years, including recognition as the Best SME Bank, Best Trade Finance Bank, and Best Project Financing Bank.

With a strategic aim of emerging as the leading retail bank in the region, SHB consistently engages in research and development to cultivate a wide array of competitive products tailored to meet the diverse income levels of numerous customers. Retail products and services are meticulously crafted for each customer, including offerings specifically tailored for priority customers and those in response to specific customer needs. Loan products undergo robust development through SHB’s collaborations and partnerships with numerous entities, consistently delivering exceptional value to customers.

SHB has also leveraged the ecosystem of large enterprises, which includes millions of employees and customers, by offering capital financing solutions tailored for their employees. These solutions encompass salary account management, consumer loans, home loans, car loans, credit cards, payment services, internet banking, digital banking, and bancassurance.

Recently, SHB launched the “30 Years of Companionship - Continuing Gratitude” program, offering attractive loan interest rates for retail customers. Retail loans for sole proprietorships, home loans, car loans, and consumer loans are eligible for interest rate reductions of up to 1.5% per annum compared to market rates. Additionally, loyal customers who use multiple bank products and services can receive incentives of up to 2.5% per annum. To make consumer loans more accessible and save time, SHB has introduced SHBFinance’s repayment feature on the Ebank SHB mobile application. This feature allows customers to conveniently, safely, and securely make loan payments for themselves and their loved ones directly from their phones, without needing to visit a bank branch.

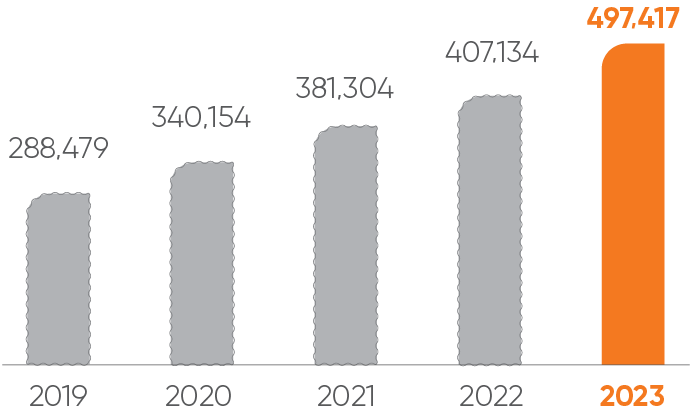

Total customer deposits have consistently grown robustly, thanks to the dedicated efforts of the entire bank, with most branches meeting or exceeding their deposit targets.

By December 31, 2023, total customer deposit increased by 22.2% compared to 2022, reaching VND 497,417 billion.

The average growth rate of total customer deposits over the past 5 years reached 15.3%, surpassing the industry’s average growth rate of 11.9%.

SHB’s substantial customer deposit also demonstrates effective and sustainable growth. Notably, savings deposits from retail customers consistently account for a significant proportion, making up 60% of total customer deposits.

Additionally, SHB collaborates with foreign financial institutions to provide customers with lower-cost, longterm financing. The Bank has been selected as the on-lending and serving bank for funding sources from international organizations and governments, including the World Bank (WB), Asian Development Bank (ADB), Japan International Cooperation Agency (JICA), and German Reconstruction Bank (KFW). SHB manages a total of USD 2.64 billion across 27 projects.

To achieve these results, SHB continuously improves its products and enhances service quality, ensuring offerings are flexible, modern, and suitable for all customer segments. The Bank places a strong focus on retaining existing customers while attracting new ones. Marketing and customer service are given top priority, evidenced by SHB’s professional service style and product consultations that build trust with depositors.

The securities portfolio continues to be structured by SHB with a reasonable proportion to use capital effectively. As of December 31, 2023, SHB’s debt and equity securities reached VND 40,060 billion. Total corporate bonds are VND 17,254 billion.

SHB engages in corporate bond trading to diversify its operations, primarily investing in short-term business bonds that enhance Bank profits. Following the Prime Minister’s directive on clean energy, SHB invested in energy sector bonds (thermal, hydropower, and solar power) in 2022, which comprised nearly 50% of its total bond investments. This financing supports project implementation, enabling businesses to benefit from government incentives. These projects, once operational, will help reduce energy supply pressures and promote environmental protection.

As of December 31, 2023, SHB’s total long-term capital contributions amount to VND 3,702 billion. This figure comprises VND 3,544 billion allocated to capital contributions for subsidiaries, and VND 158 billion dedicated to other long-term capital contributions.

In 2023, SHB’s total income surged to VND 63,038 billion, marking a remarkable 38.4% increase compared to 2022. The total operating income amounted to VND 21,328 billion, reflecting a notable 10.3% rise. Notably, net interest income grew by 9.9% to reach VND 19,285 billion. Additionally, the net gain from foreign currency trading reached VND 282 billion, witnessing a significant surge of 142.8%.

However, alongside the impressive income figures, SHB’s total expenses for 2023 amounted to VND 53,799 billion. Among these expenses, operating expenses stood at VND 5,052 billion, closely aligning with the set budget. Furthermore, provision expenses for credit losses reached VND 7,038 billion.

In 2023, amid the unpredictable developments in global economics and politics, SHB prioritized cost-saving measures. Simultaneously, the Bank thoroughly reviewed its cost structure to ensure their economic and effective utilization. The overarching goal was to ensure that the growth rate of costs consistently remained lower than that of net income.

While interest income remains the primary source of the Bank’s earnings, its fee income has consistently grown year after year. From 2016 to 2023, the Bank’s net fee income increased from VND 791 billion to VND 1,962 billion. The Bank generates fees from various services, including cash collection, cash payments, account management, internet banking, payment services, salary disbursements, bancassurance, foreign exchange and trade finance services.

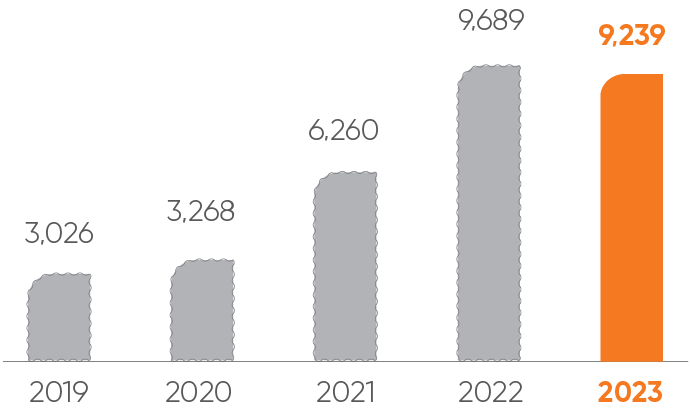

The pre-tax profit for 2023 reached VND 9,239 billion. SHB’s average pre-tax profit growth rate over the past five years has been 38.9%.

In compliance with government and State Bank of Vietnam directives, SHB has implemented substantial preferential loan programs for new and existing customers, resulting in over VND 2,800 billion in interest savings.

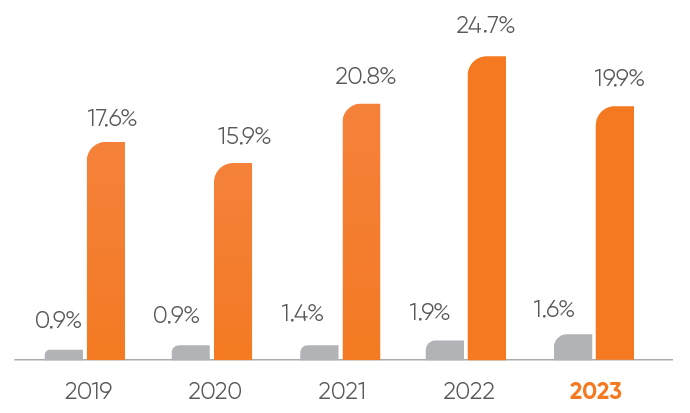

SHB ranks among the top private joint stock commercial banks in terms of high pre-tax profit growth, primarily due to low operating costs from securing preferential funding sources, enhanced risk management, and increased automation and digitalization. The integration of advanced technology has also improved management capabilities. Moreover, a significant rise in fee income from payment services and cash management has contributed to this growth. Consequently, SHB’s Costto- Income Ratio (CIR) has been decreasing, standing at 23.7% in 2023, the best CIR ratio in the industry.

In 2023, SHB achieved a return on assets (ROA) of 1.6% and the return on equity (ROE) for the same period at 19.9%. Moreover, the basic earnings per share (EPS) reached 2,555 VND per share.

In 2023, despite pandemic and economic challenges affecting customers’ operations, SHB focused on managing significant debts and consistently enhanced its provisioning to improve asset quality. By year-end, SHB’s total reserves amounted to VND 9,579 billion.

SHB consistently adheres to all regulations set by the SBV regarding prudential ratios.

In addition to achieving impressive business performance indicators, SHB consistently surpasses the SBV’s regulations and international standards in key areas such as Capital Adequacy Ratio (CAR), liquidity, and risk management. The CAR remains stable, consistently exceeding the threshold of 8% as mandated by state regulations outlined in Circular T41/2016/TT-NHNN; The liquidity ratio reached 19.66% in 2023, surpassing the SBV regulations which require a minimum of 10%; The ratio of short-term funding for medium and long-term loans stands at 26.07%, well below the SBV regulations ceiling of 34%; The currency liquidity ratio is consistently maintained within the threshold prescribed by the SBV.

Since the beginning of 2023, SHB has adopted Basel III standards in liquidity risk management. Compliance with these standards is assessed by an international consulting company to ensure adherence to best practices and requirements under Basel III standards. Additionally, SHB is in the process of implementing Basel II using the advanced Internal Ratings-Based (IRB) method. This initiative is expected to optimize capital costs and enhance risk management capabilities and financial resilience.

Capital Adequacy Ratio (2019-2023)

| 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|

| 12.01% | 10.08% | 11.86% | 12.22% | 12.20% |

(*) SBV regulations mandate a minimum Capital Adequacy Ratio (CAR) of 9% in 2019 under Circular 36, and 8% from 2020 under Basel II standards.

In 2023, SHB will continue to enhance its organizational structure by standardizing the roles and responsibilities of its divisions, departments, and centers in a professional and effective manner. This initiative aligns with SHB’s business strategy of becoming the leading retail bank. To improve business performance, cost efficiency, labor productivity, and risk management, several divisions, departments, and centers were merged, split, or newly established, including the Transformation Division and the Information Technology Division.

Since the beginning of 2023, SHB has started applying Basel III standards in liquidity risk management to ensure compliance with the best practices and requirements of the Basel Committee. This includes the application of Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR) indicators for monitoring. Simultaneously, SHB is implementing Basel II using the advanced Internal Ratings-Based (IRB) method, which will help the Bank optimize capital costs and enhance risk management and financial capacity.

In addition, SHB continues to implement and complete numerous key technology projects to support banking management, enhance product and service quality, and ensure effective risk management. Notably, during the year, SHB finalized its retail digital banking strategy and established the foundation for digital transformation for retail customers. This includes the OMNI Channel Project and the CRM Project (Customer Relationship Management System); Additionally, SHB has been supporting several projects aimed at digital transformation within the bank, such as the RLOS Project (Retail Loan Origination System), a microservices architecture consulting project for the bank’s IT system, the ESB upgrade, and the Hybrid Cloud project.

Based on 2023 business results and business environment forecasts, SHB will implement four core pillars and key objectives system-wide in 2024.

Our business plan aims to seize opportunities sharply and achieve goals with innovative initiatives and optimized resource allocation.

Unit: VND billion

| No. | Targets | In 2024 | Projected YoY increase | Projected YoY growth rate |

|---|---|---|---|---|

| 1 | Total assets | 701,000 | 42,517 | 11.2% |

| 2 | Charter capital | 40,658 | 4,464 | 16.2% |

| 3 | Total outstanding loan | 518,555 | 62,837 | 14.0% |

| 4 | Pre-tax profit | 11,286 | 2,047 | 22.2% |

(*) Credit growth limit shall be set forth by the SBV

There are no financial statement disclosures that Deloitte Vietnam finds unaccepted.

Guided by the core value of “Heart”, SHB’s leadership and staff at all levels are committed to fostering a sustainable Vietnamese society.

SHB doesn’t conduct environmental impact assessments due to its reliance on rented buildings and transaction offices.

As a financial services provider, its operations typically have minimal greenhouse gas emissions or environmental footprint. Any emissions primarily stem from tool and equipment usage, lighting, equipment maintenance, power generation, air conditioning, and transportation for employees and customers.

Despite this, as a joint stock commercial bank, SHB actively promotes environmental responsibility by directing investments towards sustainable development projects.

Employee training and awareness programs prioritize environmental protection in the workplace, emphasizing prudent resource use and conservation practices, including water, raw materials, energy, and natural resources.

SHB prioritizes adherence to legal regulations concerning employment, wages, and insurance for its employees while continually enhancing competitive benefits, fostering a people-centric workplace. It strives to inspire employees, boosting productivity and unlocking their full potential.

The Bank ensures that staff receive ongoing training to update their technical knowledge and develop new skills, while also keeping them abreast of latest labor relations.

Moreover, SHB actively promotes the activities of trade unions, facilitating the prompt resolution of rights and obligations and overall enhancement of staff’s wellbeing.

Over time, SHB has built a reputation for actively engaging in community responsibility through a range of practical and enduring social welfare initiatives.

Guided by the core value of “Heart”, SHB’s leadership and staff at all levels are committed to fostering a sustainable Vietnamese society.

SHB’s mission in social security activities extends beyond supporting vulnerable individuals; it aims to build a better future for Vietnam on the journey “From Heart to Greater Heights”.

SHB’s contributions to the community and society have been recognized with several prestigious awards both domestically and internationally, including the “Outstanding Bank for the Community 2023” awarded by the International Data Group (IDG) in coordination with the Vietnam Banking Association, the “Best CSR Bank in Vietnam” for the second time honored by Asia’s leading magazine on Economics, Finance, and Banking - Asia Money, the “Vietnam Domestic COVID Management Initiative of the Year” honored by The Asian Banking and Finance (ABF) magazine, and the “Biggest ESG Impact 2023 in Vietnam” honored by Finance Asia.

For further details, see the Sustainable Development section on page 120.